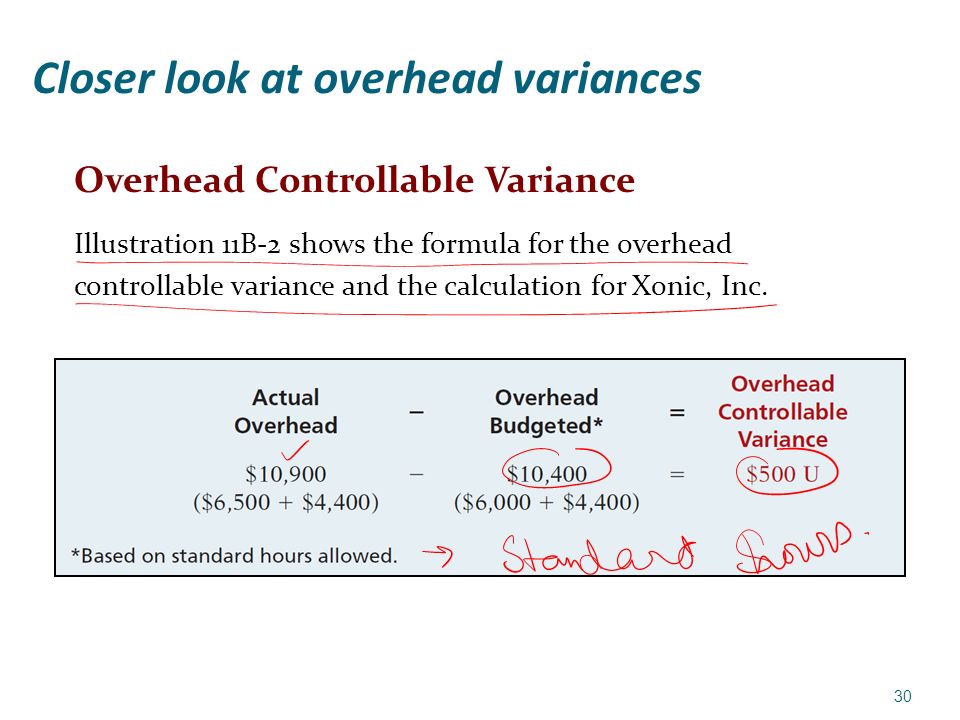

Calculation of Overhead Variances

Please do send us a request for Relationship between the variances, Variable Overhead Efficiency Variance tutoring and experience the quality yourself. If you are stuck with an Variable Overhead Variances Homework problem and need help, we have excellent tutors who can provide you with Homework Help. Our tutors who provide Variable Overhead Variances help are highly qualified.

- Chapter 46 Overhead Variances!

- Factory Overhead Variance Analysis - AccountingVerse.

- VFOH Spending and Efficiency Variances;

- !

- English Romantic Poetry: An Anthology (Dover Thrift Editions)!

- Welcoming Him Home.

Our tutors have many years of industry experience and have had years of experience providing Variable Overhead Variances Homework Help. Please do send us the Variable Overhead Variances problems on which you need help and we will forward then to our tutors for review.

Variable Overhead Cost Variance: Variable Overhead Expenditure Variance: Variable Overhead Efficiency Variance: Relationship between the variances: For a particular production department, the standard variable overhead has been budgeted as below: This may arise due to strikes, lockouts, breakdown of machinery, short supply of labour, absenteeism, etc. Overtime, change in number of shifts etc. It is an indicator of the degree of utilization of available capacity.

This variance arises when the actual production differs from the standard output for actual hours worked. The major causes for this variance are lack of proper supervision and inspection, improper handling of materials and machines, variation in production methods and changes in efficiency of machine operations, etc.

Calculation of Overhead Cost Variances

Types and Their Formula. Standard costing allows management to determine areas that deviate from established standards, to be able to investigate and take corrective actions. The computation and analysis of variable factory overhead VFOH is pretty much similar to that of direct labor. The only difference is the rate applied.

Variable Overhead Variances

Also, variable overhead rates may use direct labor hours or machine hours as its base. The total actual variable overhead cost and total standard variable overhead cost may be computed as follows:.

Note that the "hour" used refers to direct labor hour or machine hour , depending upon which is used by the company. Capital-intensive industries tend to use machine hours. Other bases may also be used, especially when using activity-based costing. Variable factory overhead may be split into: The computation for fixed factory overhead FFOH variance is similar to that of variable factory overhead.