Counting Nifty From One To Fifty:Learning Tool Concept (3 and Up) Book

Liquidity in the context of stock markets means a market where large orders can be executed without incurring a high transaction cost. The transaction cost referred here is not the fixed costs typically incurred like brokerage, transaction charges, depository charges etc. Liquidity comes from the buyers and sellers in the market, who are constantly on the look out for buying and selling opportunities. Lack of liquidity translates into a high cost for buyers and sellers. This style of market dispenses with market makers, and allows anyone in the market to execute orders against the best available counter orders.

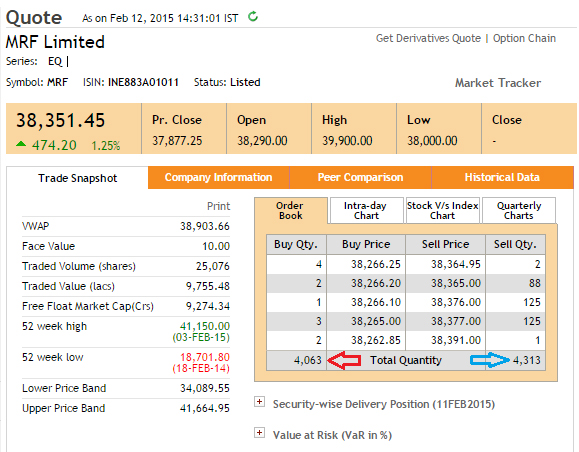

The market may thus be thought of as possessing liquidity in terms of outstanding orders lying on the buy and sell side of the order book, which represent the intention to buy or sell. When a buyer or seller approaches the market with an intention to buy a particular stock, he can execute his buy order in the stock against such sell orders, which are already lying in the order book, and vice versa.

- Blessed with a Second Chance;

- Technical tools used to predict stock market trends.

- Logan County (Images of America)!

- ;

There are four buy and four sell orders lying in the order book. The difference between the best buy and the best sell orders in this case, 0.

NSE - National Stock Exchange of India Ltd.

If a person places an order to buy shares, it would be matched against the best available sell order at 4 i. If he places a sell order for shares, it would be matched against the best available buy order at 3. Hence if a person buys shares and sells them immediately, he is poorer by the bid-ask spread. This spread may be regarded as the transaction cost which the market charges for the privilege of trading for a transaction size of shares.

Progressing further, it may be observed that the bid-ask spread as specified above is valid for an order size of shares upto shares. However for a larger order size the transaction cost would be quite different from the bid-ask spread. Suppose a person wants to buy and then sell shares. The sell order will hit the following buy orders:.

This implies an increased transaction cost for an order size of shares in comparison to the impact cost for order for shares. The "bid-ask spread" therefore conveys transaction cost for a small trade. This brings us to the concept of impact cost. One can also look the day moving average or the day moving average.

Trading is a game of probability. So, you have to arrive at your own methods to decide which parameters suit you the best. In the graph, Moving Averages, you can see the Sensex movement compared to the day moving average of the Sensex. The brown line is the moving average line. In February, the line went above the price bars and the Sensex started falling. When the day moving average fell below the price bars in April, the markets started going up. In thegraphic, the Sensex is below the moving average, indicating bearishness. But this is just one parameter. RSI is plotted on a scale of Generally, if it is above 70, the stock is considered overbought and so one can look to sell it.

Similarly, an RSI of less than 30 indicates the stock is oversold and can be bought. It reversed from 20 and the stock moved up.

Graphic Gains

You just have to select the MACD and plot it on a chart. The MACD comprises two lines, fast and slow. The fast line is the difference between the day exponential moving average and the 12 day-exponential moving average. The slow line, also called the signal line, is the nine-day moving average. So, the blue line in the chart, MACD, is the fast line and the brown line is the slow line.

- ;

- .

- Sal de vainilla (Spanish Edition).

With technology, these calculations are automated and a graph gets plotted at the click on the mouse. When the fast line crosses above the slow line, it's a buy signal, and when the slow line crosses the fast line, it's a sell signal. The chart shows that the MACD is the best way to predict the movement of a stock. Fibonacci Retracement Click here to Enlarge Fibonacci retracement is based on the assumption that the markets retrace by a few predictable percentages, the best known of which are You have to plot Fibonacci retracement from the peak price.

The software will give the above mentioned retracement levels. When the price reaches the However, if the price falls below the The chart, Fibonacci Retracement, shows how the Support and Resistance You may hear or read technical experts recommending support and resistance levels. But plotting support and resistance and finding it yourself is a simple job.

Impact Cost

As you know, prices move in a zig-zag fashion and form lows and highs. A support is plotted at the daily low price and resistance at the daily high price. For example, in the given chart, Chouhan says he sees support of 4, for the Nifty and if the index falls below this, it may fall further to 4, He has plotted resistance at 5, levels.

Take a look at how he managed to get support and resistance for the Nifty from the October 7 graph, Support and Resistance. Click here to Enlarge.