Shorting Stocks

Anyway, I think you get the idea. But I'll borrow this.

Shorting stock

And you'll say hey wait, Sal, that doesn't make sense. How can you just borrow this guy's stock? I mean, this guy might want to sell it the next day. And that's a good question. If this guy wants to-- let's say I borrow his stock, it's not sitting there anymore. If this guy wants to sell his stock the second after I borrow it, the broker is just going to take-- he's just going to shuffle around the stocks a little bit. I mean, you know stocks are-- they call it fungible, you can replace one stock certificate with the other.

So then he'll say OK, I'll just give this stock to this guy. I just messed up with my pen. I'll just give this stock to the guy who wants to sell it, and then you would have essentially borrowed from this guy. And you could keep rearranging the securities so that none of these guys ever know that their stock is borrowed. Although you have to give permission, especially if these guys own the stock outright.

They have to give permission to let the stock be borrowed, and they benefit, because they get some cut, hopefully, they get some cut of the rent, or the interest that I'm paying. So it's beneficial to them. And the broker can never, well it should never, really, lend out all of the shares here. Just so that it can keep shuffling around. And we'll talk about what happens if you actually try to do this with a share that you've never borrowed. We'll do that in a future thing. But the general idea is, you borrow one of these shares out here, and then the broker can kind of keep shuffling around these shares, if any of these guys really want to get rid of their share.

And let's say I've borrowed this guy's. Let's say I originally borrowed this guy's share. This guy wanted to sell his share. So what the broker does is, he takes this share, gives it to him, and now I have officially borrowed this guy's share. This is the share I'm borrowing now because this one's been sold. Now, what happens if IBM issues a dividend? So I have to make it look, or at least the broker is going to force me to make it look like this guy still owns the share. So anything that this guy gets by being a shareholder of this stock, I have to provide for him.

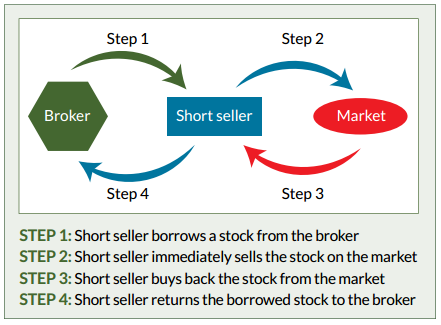

Anyway, so I've borrowed the stock. Now what do I do with it? I've borrowed this share. So I sell it. So let's see, the first thing is I borrow one share, as I've done there. And now I sell it on the market. So I sell it to the market. Let's say the market is out here to the left. So let's see what's happening right now. What's my current state of affairs? Let's say assets-- and I'll talk about margin requirements later-- liabilities. What do I have, what do I owe? And what do I owe? I owe one share of IBM.

Let's say my analysis ends up being correct, often times it won't. And we'll talk a little bit more about why short selling can be extremely risky. What I can do now is unwind my trade, or cover my short. So I buy one share of IBM. And how much do I have to pay? So actually, let me do that. And I'm going to get back a share of IBM. I'm going to get back a share of IBM, and that's what I owe. So I'll give it back to my brokerage.

- ;

- Shorting stock.

- .

- .

- Shorting stock (video) | Stocks and bonds | Khan Academy.

- Short (finance) - Wikipedia!

- The Treebobs and Air Rena: Air Rena?

These guys never knew that anything happened. And in the process, what happened? So how much do I have left? The lender receives a fee for this service. Similarly, retail investors can sometimes make an extra fee when their broker wants to borrow their securities. This is only possible when the investor has full title of the security, so it cannot be used as collateral for margin buying.

Why Short Selling Can Make You Rich But Not Popular | Fortune

Time delayed short interest data for legally shorted shares is available in a number of countries, including the US, the UK, Hong Kong, and Spain. The number of stocks being shorted on a global basis has increased in recent years for various structural reasons e. The data is typically delayed; for example, the NASDAQ requires its broker-dealer member firms to report data on the 15th of each month, and then publishes a compilation eight days later. Some market data providers like Data Explorers and SunGard Financial Systems [27] believe that stock lending data provides a good proxy for short interest levels excluding any naked short interest.

SunGard provides daily data on short interest by tracking the proxy variables based on borrowing and lending data it collects. Days to Cover DTC is a numerical term that describes the relationship between the number of shares in a given equity that has been legally short-sold and the number of days of typical trading that it would require to 'cover' all legal short positions outstanding. For example, if there are ten million shares of XYZ Inc. Short Interest is a numerical term that relates the number of shares in a given equity that have been legally shorted divided by the total shares outstanding for the company, usually expressed as a percent.

If however, shares are being created through naked short selling, "fails" data must be accessed to assess accurately the true level of short interest. Borrow cost is the fee paid to a securities lender for borrowing the stock or other security. However, certain stocks become "hard to borrow" as stockholders willing to lend their stock become more difficult to locate.

A naked short sale occurs when a security is sold short without borrowing the security within a set time for example, three days in the US. This means that the buyer of such a short is buying the short-seller's promise to deliver a share, rather than buying the share itself. The short-seller's promise is known as a hypothecated share. When the holder of the underlying stock receives a dividend, the holder of the hypothecated share would receive an equal dividend from the short seller.

Naked shorting has been made illegal except where allowed under limited circumstances by market makers. In the US, arranging to borrow a security before a short sale is called a locate.

- Short Selling Stocks | Short Selling Example?

- Navigation menu?

- Why Short Selling Can Make You Rich But Not Popular;

- Planet Janet In Orbit.

- ?

In , to prevent widespread failure to deliver securities, the U. Requirements that are more stringent were put in place in September , ostensibly to prevent the practice from exacerbating market declines. The rules were made permanent in When a broker facilitates the delivery of a client's short sale, the client is charged a fee for this service, usually a standard commission similar to that of purchasing a similar security.

If the short position begins to move against the holder of the short position i. If short shares continue to rise in price, and the holder does not have sufficient funds in the cash account to cover the position, the holder begins to borrow on margin for this purpose, thereby accruing margin interest charges. These are computed and charged just as for any other margin debit. Therefore, only margin accounts can be used to open a short position.

When a security's ex-dividend date passes, the dividend is deducted from the shortholder's account and paid to the person from whom the stock is borrowed. For some brokers, the short seller may not earn interest on the proceeds of the short sale or use it to reduce outstanding margin debt. These brokers may not pass this benefit on to the retail client unless the client is very large. The interest is often split with the lender of the security. Where shares have been shorted and the company that issues the shares distributes a dividend, the question arises as to who receives the dividend.

The new buyer of the shares, who is the holder of record and holds the shares outright, receives the dividend from the company. However, the lender, who may hold its shares in a margin account with a prime broker and is unlikely to be aware that these particular shares are being lent out for shorting, also expects to receive a dividend. The short seller therefore pays the lender an amount equal to the dividend to compensate—though technically, as this payment does not come from the company, it is not a dividend.

The short seller is therefore said to be short the dividend. A similar issue comes up with the voting rights attached to the shorted shares. Unlike a dividend, voting rights cannot legally be synthesized and so the buyer of the shorted share, as the holder of record, controls the voting rights. The owner of a margin account from which the shares were lent agreed in advance to relinquish voting rights to shares during the period of any short sale.

As noted earlier, victims of naked shorting sometimes report that the number of votes cast is greater than the number of shares issued by the company. When trading futures contracts , being 'short' means having the legal obligation to deliver something at the expiration of the contract, although the holder of the short position may alternately buy back the contract prior to expiration instead of making delivery. Short futures transactions are often used by producers of a commodity to fix the future price of goods they have not yet produced.

Shorting a futures contract is sometimes also used by those holding the underlying asset i. Shorting futures may also be used for speculative trades, in which case the investor is looking to profit from any decline in the price of the futures contract prior to expiration.

An investor can also purchase a put option, giving that investor the right but not the obligation to sell the underlying asset such as shares of stock at a fixed price. In the event of a market decline, the option holder may exercise these put options, obliging the counterparty to buy the underlying asset at the agreed upon or "strike" price, which would then be higher than the current quoted spot price of the asset. Selling short on the currency markets is different from selling short on the stock markets.

Currencies are traded in pairs, each currency being priced in terms of another. In this way, selling short on the currency markets is identical to going long on stocks. Novice traders or stock traders can be confused by the failure to recognize and understand this point: When the exchange rate has changed, the trader buys the first currency again; this time he gets more of it, and pays back the loan. Since he got more money than he had borrowed initially, he makes money.

Of course, the reverse can also occur. An example of this is as follows: Let us say a trader wants to trade with the US dollar and the Indian rupee currencies. Assume that the current market rate is USD 1 to Rs. With this, he buys USD 2.

Short (finance)

If the next day, the conversion rate becomes USD 1 to Rs. One may also take a short position in a currency using futures or options; the preceding method is used to bet on the spot price, which is more directly analogous to selling a stock short. Short selling is sometimes referred to as a "negative income investment strategy" because there is no potential for dividend income or interest income. Stock is held only long enough to be sold pursuant to the contract, and one's return is therefore limited to short term capital gains , which are taxed as ordinary income.

For this reason, buying shares called "going long" has a very different risk profile from selling short. Furthermore, a "long's" losses are limited because the price can only go down to zero, but gains are not, as there is no limit, in theory, on how high the price can go. On the other hand, the short seller's possible gains are limited to the original price of the stock, which can only go down to zero, whereas the loss potential, again in theory, has no limit. For this reason, short selling probably is most often used as a hedge strategy to manage the risks of long investments.

Many short sellers place a stop order with their stockbroker after selling a stock short—an order to the brokerage to cover the position if the price of the stock should rise to a certain level. This is to limit the loss and avoid the problem of unlimited liability described above.

In some cases, if the stock's price skyrockets, the stockbroker may decide to cover the short seller's position immediately and without his consent to guarantee that the short seller can make good on his debt of shares. Short sellers must be aware of the potential for a short squeeze. When the price of a stock rises significantly, some people who are shorting the stock cover their positions to limit their losses this may occur in an automated way if the short sellers had stop-loss orders in place with their brokers ; others may be forced to close their position to meet a margin call ; others may be forced to cover, subject to the terms under which they borrowed the stock, if the person who lent the stock wishes to sell and take a profit.

Since covering their positions involves buying shares, the short squeeze causes an ever further rise in the stock's price, which in turn may trigger additional covering. Because of this, most short sellers restrict their activities to heavily traded stocks, and they keep an eye on the "short interest" levels of their short investments. Short interest is defined as the total number of shares that have been legally sold short, but not covered.

A short squeeze can be deliberately induced. This can happen when large investors such as companies or wealthy individuals notice significant short positions, and buy many shares, with the intent of selling the position at a profit to the short sellers, who may be panicked by the initial uptick or who are forced to cover their short positions to avoid margin calls. Another risk is that a given stock may become "hard to borrow. Additionally, a broker may be required to cover a short seller's position at any time "buy in".

The short seller receives a warning from the broker that he is "failing to deliver" stock, which leads to the buy-in. Because short sellers must eventually deliver the shorted securities to their broker, and need money to buy them, there is a credit risk for the broker. The penalties for failure to deliver on a short selling contract inspired financier Daniel Drew to warn: In , the eruption of the massive China stock frauds on North American equity markets brought a related risk to light for the short seller.

The efforts of research-oriented short sellers to expose these frauds eventually prompted NASDAQ, NYSE and other exchanges to impose sudden, lengthy trading halts that froze the values of shorted stocks at artificially high values.

Short Selling

Reportedly in some instances, brokers charged short sellers excessively large amounts of interest based on these high values as the shorts were forced to continue their borrowings at least until the halts were lifted. Short sellers tend to temper overvaluation by selling into exuberance. Likewise, short sellers are said to provide price support by buying when negative sentiment is exacerbated after a significant price decline.

Short selling can have negative implications if it causes a premature or unjustified share price collapse when the fear of cancellation due to bankruptcy becomes contagious. Hedging often represents a means of minimizing the risk from a more complex set of transactions. Examples of this are:. A short seller may be trying to benefit from market inefficiencies arising from the mispricing of certain products. Examples of this are. One variant of selling short involves a long position. The term box alludes to the days when a safe deposit box was used to store long shares.

The purpose of this technique is to lock in paper profits on the long position without having to sell that position and possibly incur taxes if said position has appreciated. Once the short position has been entered, it serves to balance the long position taken earlier. Thus, from that point in time, the profit is locked in less brokerage fees and short financing costs , regardless of further fluctuations in the underlying share price. For example, one can ensure a profit in this way, while delaying sale until the subsequent tax year.

Unless certain conditions are met, the IRS deems a "short against the box" position to be a "constructive sale" of the long position, which is a taxable event. These conditions include a requirement that the short position be closed out within 30 days of the end of the year and that the investor must hold their long position, without entering into any hedging strategies, for a minimum of 60 days after the short position has been closed. The Securities and Exchange Act of gave the Securities and Exchange Commission the power to regulate short sales.

The uptick rule aimed to prevent short sales from causing or exacerbating market price declines. The regulation contains two key components: The close out component requires that a broker be able to deliver the shares that are to be shorted. This mechanism is in place to ensure a degree of price stability during a company's initial trading period. However, some brokerage firms that specialize in penny stocks referred to colloquially as bucket shops have used the lack of short selling during this month to pump and dump thinly traded IPOs.

Canada and other countries do allow selling IPOs including U. The Securities and Exchange Commission initiated a temporary ban on short selling on financial stocks from 19 September until 2 October Greater penalties for naked shorting, by mandating delivery of stocks at clearing time, were also introduced. Some state governors have been urging state pension bodies to refrain from lending stock for shorting purposes.

Between 19 and 21 September , Australia temporarily banned short selling, [45] and later placed an indefinite ban on naked short selling. Advocates of short selling argue that the practice is an essential part of the price discovery mechanism. Such noted investors as Seth Klarman and Warren Buffett have said that short sellers help the market. Klarman argued that short sellers are a useful counterweight to the widespread bullishness on Wall Street, [53] while Buffett believes that short sellers are useful in uncovering fraudulent accounting and other problems at companies.

Shortseller James Chanos received widespread publicity when he was an early critic of the accounting practices of Enron. Commentator Jim Cramer has expressed concern about short selling and started a petition calling for the reintroduction of the uptick rule. Wright suggest Cramer exaggerated the costs of short selling and underestimated the benefits, which may include the ex ante identification of asset bubbles. Individual short sellers have been subject to criticism and even litigation. Asensio , for example, engaged in a lengthy legal battle with the pharmaceutical manufacturer Hemispherx Biopharma.

Several studies of the effectiveness of short selling bans indicate that short selling bans do not contribute to more moderate market dynamics. From Wikipedia, the free encyclopedia. This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. April Learn how and when to remove this template message. Banknote Bond Debenture Derivative Stock.

Fixed rate bond Floating rate note Inflation-indexed bond Perpetual bond Zero-coupon bond Commercial paper. Corporate bond Government bond Municipal bond Pfandbrief. Securitization Agency security Asset-backed security Mortgage-backed security Commercial mortgage-backed security Residential mortgage-backed security Tranche Collateralized debt obligation Collateralized fund obligation Collateralized mortgage obligation Credit-linked note Unsecured debt.

Government spending Final consumption expenditure Operations Redistribution. Central bank Deposit account Fractional-reserve banking Loan Money supply. Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. This section does not cite any sources. Please help improve this section by adding citations to reliable sources. Archived from the original PDF on 22 July Retrieved 5 July