Algorithmic Trading - Algorithmic Trading Strategies - FDAX: Updated Results - Volume 30

The edge in Hold'em is kind of gone. PLO is still pretty exploitable though. The same is true with HFT. Most strategies in HFT no longer work but there are definitely ones that still give you a lot of edge-you just have to think harder: So true, and frustrating. But, the legalization of online play could bring back another boom at least for a couple of years. Thanks for posting this so I didn't have too. Poker is "a game of skill with an element of luck" and should not be confused with say, gambling on roulette or the outcome of a coin toss.

The same could be said of HFT. Traders are "skilled" at having nanosecond access to the orderbook, having their servers co-located in the same rack space as the exchange itself. They are also "skilled" at recognizing a price movement nanoseconds before it actually happens and getting their order in just in time. But the HFT game changes and you have to keep up. Just as a poker player from 10 years ago would not survive in the game today without adapting his style of play. Hey, I didn't actually intend this to be a course.

I do not make any money in the market right now so am certainly not qualified to teach a course on it. And of course, if I was making money in the market I wouldn't have posted this at all. So please everyone remember that. These comments have made me realize it's probably for the best if I do not post the source code. Basically you are competing against armies of PHDs who are buying buildings next to the exchange so they can get their executions slightly faster.

It is indeed surprising to me that I was able to make money in the first place. But I do know for a fact that I did make money and I also know that I was not at risk of losing a bunch of money. That's all I was risking. FWIW, I couldn't see your pnl chart. I develop algorithmic strategies for a living, and my first reaction to reading your post was skepticism.

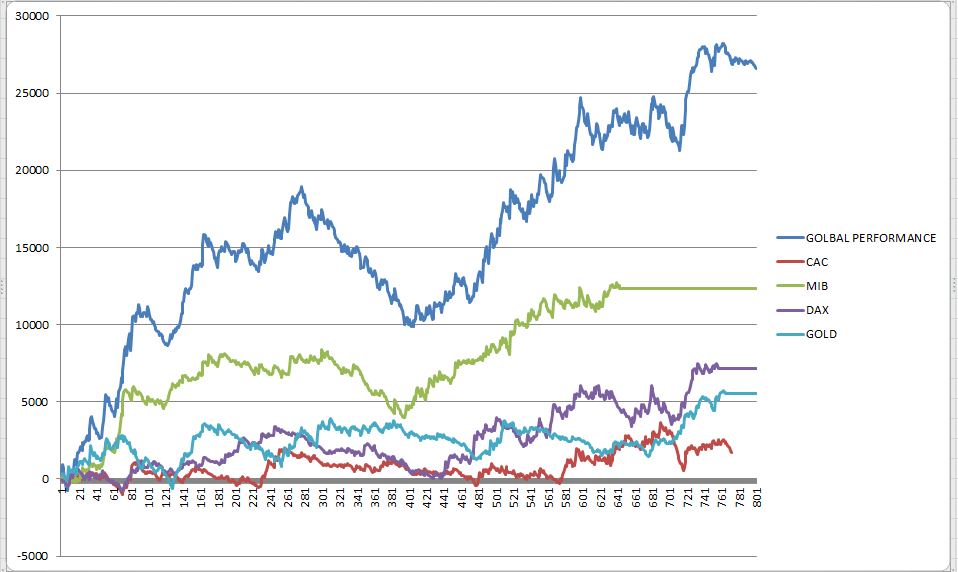

I'm skeptical for two reasons. I can't tell you how many people I've worked with who fail to isolate the source of their pnl myself included at times. It's important to benchmark your strategy against other stupid ones that you know don't have edge. When someone shows me strategies that worked in and , I immediately make them prove their strategy was not the equivalent of being long equities. Doing this will truly help isolate whether or not luck is involved. When you say that the number and size of your trades justifies the strategy's validity, that's just wrong. You could do trades in a day: In a bull market like , that would have made k, and would have nothing to do with Machine Learning or its applications to HFT.

I make all traders benchmark their work against a series of other strategies that I know have no edge, even though they, at times, can appear to have edge. Now, I'm not saying you didn't have legitimate edge, but you do your readers a disservice by omitting relevant stats and discussions like that. It would, in fact, closely describe the methods of more than one shop I'm familiar with. Except they WERE able to overcome the declines. And the month indicator lifetime looks eerily familiar.

And these places are anything but "convention rules" - it's "creativity rules, before our competitors get creative enough". You are welcome to demonstrate that there is.

Sounds to me like you are doing low frequency strategies; it's a completely different ballgame than HFT. He's done , trades, half of them long, half of them short. It might have been luck, and he might have been riding something underlying the equities, but this is NOT equivalent to being long equities.

He might have found a way to get non-linear leverage rather than prediction. But that's also worth a lot of money in the right hands. Assuming, of course, he is telling the truth. You are right - I should clarify things by saying my program had no directional bias. Are there other stats I'm missing? Given a max loss of 2k, we already know the Sharpe Ratio was pretty good. I know this is high frequency, but like I alluded to, you need to make sure that what you're doing isn't replicating the pnl profile of low frequency strategies. So, how did you perform relative to vol sellers?

So your returns do sound better, but not incredibly. But, even if you failed to perform as well as vol selling did over the same period, that doesn't negate the strategy's validity. If returns were not correlated, then it's safe to say that you weren't just inadvertently shorting vol. So, start there, work out a regression comparing your daily returns to someone selling vol.

Do the same with moving average strategies. Mocking up a simple market making back test versus an ES beta is hard, but that too would be a something to test against. I don't expect you to do any of this, and I'm not going to bother to either. I'm just saying that a complete discussion of this subject would include that information. Guess you are familiar with http: In , there were probably tonnes of people trying to exploit the market using similar low-tech methods as you. Even if all of them were at best break-even, some of them likely made a lot of money on their unprofitable algorithms by pure chance thanks to the size of the cohort.

Those few blogged about it and those who lost money didn't. I'm not saying that you just were lucky please dont take this as criticism - survival bias is just one of those things that always come to mind when people write about how they broke the market or when some investor is presenting his incredibly smart investment strategy that has netted him millions.

It's a great point and seems like a very smart thing to keep in mind. I think in my case, based on the statistics involved, the odds that my success was luck just seems astronomically small. But, guess I'm biased in my own way: By luck and skill you found a temporary systematic bias that other players missed. It was even luckier that you found it without a lot of upfront losses. But you could have made many attempts and not found any bias and overall lost money and gave up.

If lots of people are losing small sums to find these biases, then it may be that the expected return of trying to find biases is zero or negative. At best HFT is a near zero sum game.

- Find a market to trade?

- Open an account.

- Books by Fudancy Research?

- Open an account.

It isn't creating value for customers. It isn't making the world a better place. It is an unfortunate flaw of our economic system that so many smart people put so much effort into playing zero sum games with each other. An example of your last point. These chips contributed to the market position of one of today's leading mobile phone manufacturers. Today, this engineer is designing ASICs for high frequency trading basically a specialised Ethernet switch, with all extra logic stripped out, so packets go through a few nanoseconds faster.

HFT isn't a zero sum game. It's sucking resources away from productive disciplines into an unproductive discipline, so making a net negative contribution. Why are you ignoring HFT's positive contribution? Could you please elaborate what that contribution is? It's always the same bullshit excuse: It's just that you pretty much need to be another HFT bot to partake in that liquidity.

From what I understood, this contribution is not about making stuff nanoseconds faster, but about how this pushes spreads down. Anyone doing any trading will be happier to see the spreads smaller, wouldn't he? I don't know if there is a special word for it in this context. AnIrishDuck on Nov 7, HFT reduces counterparty risk for market makers because with HFT, it's much more likely that there will be a counterparty for any given trade.

This enables the market makers to reduce their bid-ask spreads; the profit from the bid-ask spread is what covers the risk a market maker faces from their market clearing obligations. Do you know of any data on the size of the spreads over time? People call the liquidity providing aspects of HFT 'bullshit', but computers have vastly reduced the manpower necessary to manage a market.

Many firms needed multiple traders in a pit, just to be able to make sure they could provide liquidity to all possible market participants. Today, a couple strategists with a small team of programmers can cover dozens of futures markets at once. The same principle holds across bond, FX, equity and options markets alike. HFT has supplanted a terribly inefficient market with a better one.

Is it perfect or even good? Probably not, but it's magnitudes better than the traditional method. An argument can also be made that this is a net negative contribution, as instead of a market employing hundreds of people, it's only employing dozens. Ergo, more unemployed people. While this is good for the market's owners and those currently employed to trade there, it is bad for the economy as a whole. You're on Hacker News, but you think that destroying jobs with technological innovation is a bad thing? Not at all, but in re-reading my comment I can see why you'd think that.

My intention was to make a devil's advocate comment: There are plenty of arguments for its contribution. I don't need to repeat them. Please help me understand this better? With a deep understanding of markets and trading I fail to see why you see 'luck' as an explanatory variable is inversely correlated with the frequency of your trades notwithstanding the effect of trading expenses?

Cheap algorithmic trading deals

From what I have gleaned the following seems to be true: Your algorithms worked made money 2. Then your algorithms did not work, but you could not figure out why If you do not know why something stopped working it seems unlikely that you had a full understanding of why it was working in the first place.

Without understanding the nature of the predictive value of the algorithm while it was working, its success seems to be good fortune. Your algorithm could have shown a systematic correlation to any number of factors that could have created strong performance over several months. Performance would then be attributed to accidentally 'timing' a favorable market.

I know you feel differently, what am I missing? I think you undersell yourself - kudos to your success. I'd back a hacker with a plan and a cash flow crises perhaps over an army of PhDs any day! Maybe the course you should think about teaching is how to how to orgainse such a high-quality hack as you've described in the article: I'm currently building a semi-high frequency trading solution and the problem I run into is the sheer breadth of expertise you need to get it all happening.

Modern chip design, low-latency, lock-free concurrent messaging, fault-tolerant system design, adaptive learning algorithms, k-means clustering and broker APIs are just a smattering of the ideas I'm trying to get across to make progress. For me, algorithm creation comes more easily than reading about and implementing a broker interface. There is certainly armies of PhDs out there backed by big money but they exist behind heavily guarded intellectual property walls.

Thank you for posting this. Very interesting to read. Perhaps posting the source code would not be a good idea, but posting more details would be welcome so that people interested could follow their own path to automated trading. JoblessWonder on Nov 6, I didn't see it in the article and I'm sorry if I missed it The Instagram guys found an edge. It won them m. More than any edge ever won by me. But the market has changed so much since then, please be careful before you follow this course. You are not wrong, but what you wrote here is applicable to any success story posted on HN.

I think with the automated trading example, it makes it seem much easier for anyone to dip their cup in the stream. When you think automated trading, you think, "Hey, it can't be that hard", and start firing up your IDE and rolling out code to talk to an easily provisioned API. You can lose everything overnight with automated trading. Something very important I learned from him was: In the right market, bottom is much further down than you can ever see. I'll take it ad absurdum: You can lose everything in a second by not looking left and right while crossing the road.

Or even by looking left and right while crossing the road, when someone else is driving recklessly. Yes, you can lose more than you put in your margin account, but not by much. While that's more, upfront, than InstaFaceGoogApple, it is comparable to the 4 months of salary that you're going to forfeit while building the InstaFace service. And unlike most InstaFace apps, you have immediate market feedback, which can only be a good thing. Instagram did have immediate feedback from the public at large, forcing them to scale much earlier than they expected - but they did not have a feedback as to the financial value of their proposition.

In fact, it wouldn't take much for instagram worth to be zero. And yet no one keeps yelling "but most startups lose money! Which is what we should address, and these "it's a gamble" warning do not. When you see Suzanne Vega singing, you might think "Hey, it can't be that hard to sing". And yet, they grow out of it, usually without trying to publish an album and failing. This should be no different. The point is you are lured into crossing the road, when you absolutely didn't have to. How are you "lured" by reading an article about someone who successfully crossed the road, any more than you are "lured" into a singing career by reading about Adele or "lured" into building an instagram clone?

Kranar on Nov 11, No broker is offering the ability to engage in HFT for 10 grand. Not to mention the overall costs including hardware, co-location, market data and other vendor costs are on the order of k a month. I have a commodities trading account I use to trade corn, soybeans, and hogs. Now if you're talking margin accounts, sure, you're going to need more. I welcome the fact that the Estates Committee-to judge from their poker faces and imperturbable demeanour-do not take either gains or losses from the Stock Exchange too gravely-they are much more depressed or elated as the case may be by farming results.

But it may be useful and wise nevertheless, to analyse from time to time what is being done and the principles of our policy. Worlaby and Elsham was a farm that the endowment owned. Wow that is a gem. Keynes was a giant. Wish the political parties wouldn't run from him. A wonderful quote, but this is the only google result for it.

Can you provide a source? Limit the amount and value of orders. With stocks, worst case: I'm very familiar with stop orders. They're useless once the market goes to hell the exact conditions you need them in. I love this comment: I agree with toomuchtodo. It's just too easy to risk with HFT that the warning is needed here more than elsewhere.

As entrepreneurs we all educated risk takers, and we realize any venture is essentially gambling if there is no edge. At any time, there could be a new idea that pushes any one HFT algorithm or mobile photo sharing app, or words with friends clone past the established mindshare into blue ocean territory. When that time comes, do you want to be caught with your pants down, lumbering under the excuse that you thought the oceans were too red for you to bother?

This is a very mean and unconstructive comment to someone who made the impressive achievement of building his own automated trading system and actually making money from it. I've started calling out comments like this one, because they cause a bad environment for useful discussion. The only argument in your comment that isn't your own unfounded opinion is that market makers make money from people who execute trades. But this is true by definition.

The traders who "gleefully picked off all those trades" weren't outsmarting anyone, they were simply profiting from the difference in the asking and offering price in the market. This is the role of a market maker, and actually makes it cheaper for people like OP to execute a large number of trades. So even though this comment sounds like a sensible rebuttal of the linked article, it doesn't really say anything at all.

Again, sorry for creating a negative reply and contributing to a bad tone, but I really the right thing is to call out these kinds of replies. They discourage honest sharing and discussion. KingMob on Nov 6, While writing his own trading system is a decent accomplishment, due to things such as an overall rising market in the time period involved and survivorship bias, the original author is likely to be completely mistaken about the reason for his winnings.

Given that he might convince other people to engage in high tech gambling in a less-favorable market than the one he operated in, strong words are called for in this case. You could argue this, but in that case your arguments have to hold water and not just be a cursory dismissal. It is only gambling in the sense that any business is gambling: And indeed, living is gambling. You can't live without gambling - by e. Every business has a risk element, but what makes this gambling is that there is no good or service being produced.

It's a game of trying to outguess the other players, with one trader's gain being another trader's loss relative to market returns. Because there's a commission on trades, and because you pay taxes on net gains but your minimum tax is zero, high frequency trading by its very nature must a loss for most players.

As a professional poker player, analyst and journalist, and being fairly well-read on classifications of gambling vs skill game in different jurisdictions, I have not before come across a definition of gambling that was rooted in the idea that "no good or service is being produced. Any zero sum or negative expected return conctract would meet this definition quantitatively. I was not aware that this is what defines gambling. And "no service produced" is certainly wrong by accepted economic theory - arbitrageurs provide a price discovery service for everyone; they get rewarded for exposing the inefficient prices, even though it is done through market mechanics rather than a specific customer.

OP appears to be a statistical arbitrageur - which is the same concept, except that it includes a shift in time or space and incurs risk. You might not be interested in this price discovery service, but other people are paying for it with their wallet. That's not true in investing in general - when shares have time to appreciate or depreciate, it is definitely not a zero sum game.

Everyone can win, or everyone can lose, or anything in between it all depends on your time range, and your measure of loss or profit. The "non-zero-sum" element arrives partly from companies using operating profit to buy back their own shares. That's only true if all players are hf players. If there is sufficient non-HF activity, then the zero-sum argument does not hold.

I'm not saying that it's not a good approximation - in most time scales, in most scenarios, it is - but it is not the mathematical truth you imply it is. Futures, which I assume was the original poster's instrument of choice, are a zero sum game by definition as every contract is an agreement between two parties: Only if you assume all players only ever use futures. But make an interest synthetic contract short future long underlying and you're out of the zero sum regime again. And it's enough that one actor is not inside the zero sum regime to make that apply to the whole game.

Again, it's a great approximation most of time and over most time periods and asset classes, but it is NOT axiomatic in the way most people believe it is. Just assume one of the stocks is a gold mining company that works efficiently. The share value rises, and the shares are redeemable for the gold, without anyone having to lose anything except mother earth. So consider an insurance company.

Would you say that this company is providing no service? It sounds like you are making the argument that this is zero-sum game, but whether something is zero-sum depends on your utility function. If the players are risk averse, then a transaction like buying insurance can yield positive utility for both participants. Many trading strategies are performing a service in similar but more complicated ways. OldSchool on Nov 6, That is, if you're in business to make a profit, not just spending OPM to build your brand. Even acquiring a customer is a gamble.

At the same time the very fact that obviously seen most of the posts here most people don't understand basic bankroll management, risk management, standard deviation, expected value, variance, etc. I think the real problem as with so many problems is definitional. What does "gambling" actually mean? If I tried to kludge together a definition, I might come up with something like: It also includes no distinction between risks with a positive expected value and risks with a negative expected value.

What we really need is a word that only refers to gambling in situations with an expected value less than or equal to zero. For the sake of clarity, I meant: BrandonM on Nov 7, I believe we call that gambling. I'm a pretty risk averse guy and my typical reaction is to figure out why something won't work. Most of the time I'm right.

What troubles me is encapsulated in the following parable: A UChicago economist and graduate student are walking across campus. The economist scoffs and says no there isn't Sometimes I catch myself thinking this way. I have to remind myself that a markets aren't perfect, and b the real world has huge asymmetries in information, ideas, and perhaps willpower by this, I mean while people might think of a great idea, not all will attempt to implement it; even then, people will differ in execution.

That said, you're likely right. This trading strategy will likely lose money today: It's easy to fall into that mindset. And in fact, that mindset is right back where I am now. The only reason I had the gall to attempt this in the first place was the the simple fact that I was making money at the time in 'manually' day trading the Russell I thought this 'should not be possible' so I figured there's no reason not to try an automated program. People will tell you that you were just a lucky monkey. But you could have run your algorithm on past data, for hundreds or thousands of fake portfolios, to tell, statistically, what the odds of your algorithm being simply lucky are.

It predicted a full trading day in advance. But that was all on paper at trading firms' puny costs; unlike you I couldn't beat retail costs. It's amazing that you could do that. For that reason alone I think it's highly likely that you were a skilled monkey. Also like you, nobody in the industry was interested in my code, even after an industry magazine watched it for 3 months and found it gave "stellar" performance.

The few people I was able to discuss it with told me point blank that it was impossible to do it skillfully efficient market theory , so they assumed it was a hoax or the algorithm was just lucky. What did you end up doing with your code? Would you be able to run it today with the low-cost broker APIs? The code sits in one of my archive folders. I ran it for a few years, perhaps to , and saw the market steadily becoming more efficient, lowering my results like the OP did. It may well be that it no longer predicts skillfully or profitably.

Looks like the OP did that by throwing a bit of market making into the mix. If you make that many trades and your total market exposure at any given moment is small yet you consistently make a net profit then you've found an edge. At which point it's not really gambling any more, it's just making money!

I tried to address this concern at the start of my post. If you have some idea of how I manipulated the statistics I'd be happy to respond. Having said that I can agree that my case is pretty unusual and that everyone should beware of attempting to do something like this. Even for myself I couldn't do it now. There is a reason I turned my program off. All I know is that you had one good run, similar to how some mutual funds have a good run for a while.

How much did you spend before you "tuned" it? How much did you spend afterwards? What were the tax consequences of your trades? Did you make exactly k? Have you traded at all since then? You mentioned that you occasionally "sat in" and took some large losing positions. Were these on purpose? Was your exposure actually much higher than you thought?

Was limiting contract size enough risk management? I didn't include this on the chart to keep things simpler visually. Since then I have not traded and the reason is that it was abundantly clear that my program was no longer working. That's why I shut it off. So once I had that I could basically use it to verify I had sufficient edge to make a profit after covering my commissions. My risk exposure was very low. Anyway, there is not really some hidden thing that I am not telling people.

It does bug me a bit that your comment is at the top given that it says I'm manipulating statistics and was actually one of the guys that the quants gleefully picked off. If you do release the source, what's the best way to be notified of this? Your Twitter account looks pretty active? I'm particularly interested in your risk management strategies this is where my previous efforts fell short. Why couldn't you do it now? Well I could try.

High Frequency Trading

But it's not going to be any easier now than it was in For four months I tried everything I could think of to keep it profitable but in the end nothing worked so I had to shut it off. I have two theories why it stopped working. I think the market sped up. Latencies are always getting lower and your strategy that worked at 10 ms didn't work with players that are at 1 ms. HockeyPlayer on Nov 6, I run an HFT group, and what he describes isn't what we'd call "retail".

He was doing a number of things that professional shops do, including making markets to avoid paying the spread and paying attention to queue position to predict execution With a bit of luck and a good partner, this guy could have built a sustainable business. I don't get you haters. But its a pretty good high level description of the architecture of a hft system. I was a quant at GS and these are not the retail investors you pick off. You have your own set of alphas and most of them are meant to pick on mom and pops clicking away at home.

This guy didn't reveal his strategy but nevertheless the graph shows his strategy had a significant edge. The lifetime of a strategy also looks like that. It is another thing that his title for the post is kind of off. ScottBurson on Nov 6, There's a sentence in this article that is critical and yet very easy to overlook: That already gave him a lot of knowledge of how the markets work and where an edge might be found. I think that if someone is a good programmer and has some mathematical chops and has that kind of experience daytrading, taking a shot at automated trading is probably a reasonable thing for them to do.

Without all of that background, you're right, they're almost certain to lose money. The point of the article was the show the steps required to develop a statistical advantage in the market place. If you develop a robust model and are very diligent in how it executes and learns, you can be successful. However, what you say about market structure is true. It goes through periods of stability, followed by abrupt changes. Any model that a trader has developed has been developed on such a short time-scale of market activity, that it can turn out to be a bad sample size.

Depends on the scale of time and trades. You know, that is a really good argument. If market inefficiencies exist to be exploited, then someone is ultimately getting the short end of every stick. I have a few times, but only in simulation. Even using very elaborate machine learning methods and a lot of training data, making money from automated trades is a difficult problem, and my impression is that it's very much like betting on horses or football games.

How is it like horses and football games? Don't the latter have a lot more people playing with their emotion rather than utilizing an algorithm? Something that you can take advantage of? I once worked for a software shop, and part of my job was writing trading code in a proprietary language for customers, who ranged from low end day traders to 8 figure annual revenue hedge funds. I had access to all kinds of tools, and saw many a varied strategy. There's quite a lot of money to be made selling solutions. I won't day trade. What kind of solutions? Would you dare to "predict" the direction of this FX rate movement in the next month?

And yes, as with any high risk investment, putting all your eggs in one bucket is not a brilliant idea. Just like taking all your savings to Vegas. However, that isn't necessarily a bad thing. If you have a situation where you can gamble with a long-term positive edge, then the proper strategy is to play with as much money and for as long as possible. The determining factor here is whether or not the combination of a particular investor's strategy, algorithm, and ability to execute will give them a long-term edge over others in the market - not whether or not this may be a risky activity in the short-term.

Gambling can be done intelligently and profitably. Don't be so quick to label gambling as a pitfall to be avoided at all costs.

Are You an Author?

It is thousands of thousands of gamblings with a consistent winning ratio. Uh, if you look at his daily pnl charts, it looks like gambling with some extremely great odds, he rarely looses any money. That pattern is typically associated with HFT, If you can do many small trades and your strategy really has positive expected value you'll get great returns. I don't expect it would work now though, the HFT market is much more competitive these days.

If you've really worked in that field than it's very surprising you've never heard about what professional poker players call bankroll management and they "stole" the concept from professional traders. The whole point is that you can --either if you gain an edge or get lucky-- win big. But you're never exposing a large part of your funds in the process.

He wouldn't be broke. He wouldn't be without a car and without a bank account. But there's no upper limit as to how much you can win. All you need is discipline and sound bankroll management. This is simply not how it works and it's very well explained in OP's article. He's detailing what his maximal daily exposure was and it was tiny compared to what he made. Risk management is probably the single most important thing to understand in trading.

Unfortunately, it's something that lots of people learn late, if ever. Folks get caught up in the romantic notion of betting it all and winning big, but end up losers. Meanwhile, the consistent winners they aspire to be are exposing perhaps 0. I like the distinction between risk management and the romantic notion of betting it all and winning big. I see the same pattern in other areas as well, e. I think of it as the cowboys versus the tax accountants.

Algorithmic Trading - Algorithmic Trading Strategies - Trading Systems: DAX working codes in VBA

I actually thought about making that analogy, but it seemed unnecessary as the analogs are just so common. Though, one thing I think is a bit unique to trading is prevalence of folks who preach without practicing. Just about anyone with a brokerage account can rattle off the same short list of critical do's and don'ts, but very few actually follow them. I have some friends that have made a lot of money playing poker. The analogy is very good. But, in poker you have to be willing to deal with much bigger ups and downs than what I had to deal with. You can hit a bad streak and it can hurt - even if you are in fact a really skilled player and do in fact have an edge.

There are plenty of ways to minimize risk. That's incredibly low variance--my graph over the long-term was better than a 45 degree incline. Yes this is the point I was going to write myself. The way I structured my bankroll made it actually impossible to go broke as well. Stop-losses are not as effective or nearly as simple as they are described in typical financial media. I don't get that. It would be true if he just made a few trades, but the author claimed to be making trades a day. Over a period of months winning that wouldn't qualify as blind luck. Definitely not blind luck; but boosted by the fact that SPY was on a massive bull run at that time.

This is really cool, any way you cut it. DanBC on Nov 6, He doesn't say what his daily volatility was, but let's assume 2k which squares pretty well with his claim that his worst day was a 2k loss. I'll use a t-distribution with 3 degrees of freedom, which allows big up and down swings again, accentuating the effect of luck.

And remember that this simulation is overestimating the effect of luck. By that definition you could start claiming everything as blind luck. Why bother doing anything at all, let luck do the work. I don't have much experience with finance or working experience with machine learning, but I've always wondered how much room there was for a clever amateur to profit in this space, even as it's crowded with much more sophisticated professionals with much more sophisticated algorithms and machines.

He talks about a chess tournament in which it was "anything goes" The expected outcome was that a grandmaster using a Deep Blue-like computer would win, but the winners ended up being a couple of amateurs with three computers: The winner was revealed to be not a grandmaster with a state-of-the-art PC but a pair of amateur American chess players using three computers at the same time.

So in HFT, how much room is there for an amateur to profit over professionals by having a sophisticated process? Good point, I also wonder about the potential to exploit the algorithms used by the "professionals. Its hard to be optimistic about these two ideas because while the chess example is a good story, its not analogous for many reasons, ranging from disparity in available information to players to a difference of several magnitudes in saturation.

Not to mention HFT just isn't chess. So 'theoretically', they've already done what is being suggested here. If someone comes along and develops a winning strategy, it really shouldn't be considered as having anything to do with 'professional strategy vs novice strategies'. It would just be about one person either getting really lucky or coming up with something that is genius in its own right.

Theoretically, there should be no other possible strategies. Inevitably someone will come up with one though, and the 'sample space' will grow. But its extremely unlikely that additional unique strategies are successful just because they 'counter' the strategies in the sample space. But then again, this is real life and these things aren't impossible. There is an air of either incredibility or sheer jealousy in these comments. Nevertheless, I just wanted to tell the OP that he did a great job.

I work in the finance industry as a quantitative software developer, and it certainly is not an easy job for one person to do. In fact, I tried independent of my professional work doing this myself, and I ended up losing a lot of money. If people are trying to do this, please please be careful. Big companies, like ones I have worked at, have technical and human resources that are vastly more powerful. Great work, very interesting to me. Counter to what we're constantly told through the media this stuff can be done.

Doing it year after year seems to be the elusive part. I developed a fully-automated low-frequency stat arb system that I ran in based on a perhaps even simpler algorithm. It traded various equities equally to the long and short side regardless of market conditions so widespread rally or collapse was irrelevant. Month-to-month the results were very consistent until the uptick rule was nixed in July August was a record winner for me, but Sept-Dec fell flat, not losing, but with greatly diminished profits and the same variation and more frequently getting slammed all-long or all-short instead of a mix that was often near-neutral.

Also getting fills better than my orders then completely disappeared, as this was the beginning of the HFT middlemen - including your own brokerage. I shut it down at the start of , keeping the profits intact and moving on to other priorities. I continued to monitor the theoretical results for a couple of years but the conditions didn't return so I eventually cancelled my data feed.

- Gods Trophy: Becoming Gods Prized Possession.

- Pobre Chica Trabajadora (Spanish Edition).

- Fudancy Research.

CFDs are a leveraged product and can result in losses that exceed deposits. Trading CFDs may not be suitable for everyone, so please ensure you fully understand the risks and take care to manage your exposure. Established in Over , clients worldwide 15, markets worldwide. Your aggregate position in this market will be margined in the following tiers: Tier Position size Margin 1 0 - 4 Contracts 0.

Demo account Create Account. Find a market to trade Share Finder. Why trade with IG? Free live prices, data Plus news and opinion from our expert analysts. Over 15, global markets With trading opportunities 24 hours a day. Desktop, mobile, tablet Seamless functionality with our multi-device platform.

MT4 platform Superior execution with no third-party bridges. Create account Demo account. Other positions taken by clients trading this market. Oil - US Crude. IG client account sentiment: Sign up today Open an IG account and start trading today, or test-drive our platform with a risk-free demo. You might be interested in Execution and pricing Get fast, reliable execution and the best available prices.