Instruments of Monetary Management: Issues and Country Experiences

Lessons from Recent Experience. Financial Sector Crisis and Restructuring: Frameworks for Monetary Stability: Policy Issues and Country Experiences. Monetary Policy in Dollarized Economies. Instruments of Monetary Management: Issues and Country Experiences. How to write a great review. The review must be at least 50 characters long. The title should be at least 4 characters long.

Your display name should be at least 2 characters long. At Kobo, we try to ensure that published reviews do not contain rude or profane language, spoilers, or any of our reviewer's personal information.

Join Kobo & start eReading today

You submitted the following rating and review. We'll publish them on our site once we've reviewed them. Item s unavailable for purchase. Please review your cart.

You can remove the unavailable item s now or we'll automatically remove it at Checkout. Continue shopping Checkout Continue shopping.

The role of fiscal and monetary policies in the stabilisation of the economic cycle

Chi ama i libri sceglie Kobo e inMondadori. Issues and Country Experiences by. Available in Russia Shop from Russia to buy this item. Or, get it for Kobo Super Points! Edited by Tomas J. Balino and Lorena M. Zamalloa, this volume deals with the design, implementation, and coordination of major monetary policy instruments, highlighting relevant country experiences. In particular, it discusses how to adapt those instruments to the financial environment as well as how to help this environment to develop.

See what has changed in our privacy policy. The great depression of the s has had a profound influence on both economic and political thinking. The consequences of this event turned out to be of such a dimension that broad consensus emerged on governments doing their best to prevent such disasters from happening again.

- Hooponopono. Conéctate con los milagros (Psicología y Autoayuda) (Spanish Edition)!

- Join Kobo & start eReading today!

- Les Cavaliers des Madres: Cowboys des Pyrénées-Orientales et autres récits (French Edition).

- Instruments of Monetary Management : Issues and Country Experiences.

- Successful Christian Living.

- Instruments of Monetary Management : Issues and Country Experiences.

But even beyond this extreme case, there is general agreement that a stable and predictable economic environment contributes substantially to social and economic welfare. In the short-run, households prefer to have economic stability with continuous employment and stable incomes, allowing them to maintain stable consumption over time. In the long-run, unnecessary economic fluctuations can reduce growth, for example by increasing the riskiness of investments.

A highly volatile economic environment might also have a negative impact on the choice of education profiles and career paths. In short, by maintaining a stable macroeconomic environment, economic policy can thus contribute to economic growth and welfare. But what needs to be stabilised and how? These questions have long been debated by economists and — without surprise — the answers provided have changed considerably over time.

Minsky, at the time a leading authority on monetary theory and financial institutions, saying:. The debate between Keynesians and monetarists often focused on the effectiveness of policy instruments, with monetarists arguing for the ineffectiveness of fiscal tools and Keynesians believing in the superiority of fiscal stabilisation policy. His view on stabilisation policy was grounded in the firm belief that the economic system is eventually self-stabilising whereas available knowledge about the economic system is too limited for effectively addressing short-run fluctuations.

From a purely economic viewpoint, the optimal degree of stabilisation depends on whether observed macroeconomic fluctuations constitute efficient responses of the economy to shocks or whether these fluctuations are partly due to economic frictions, to be addressed with the tools of stabilisation policy.

In an article published only two years ago, Robert E.

Reward Yourself

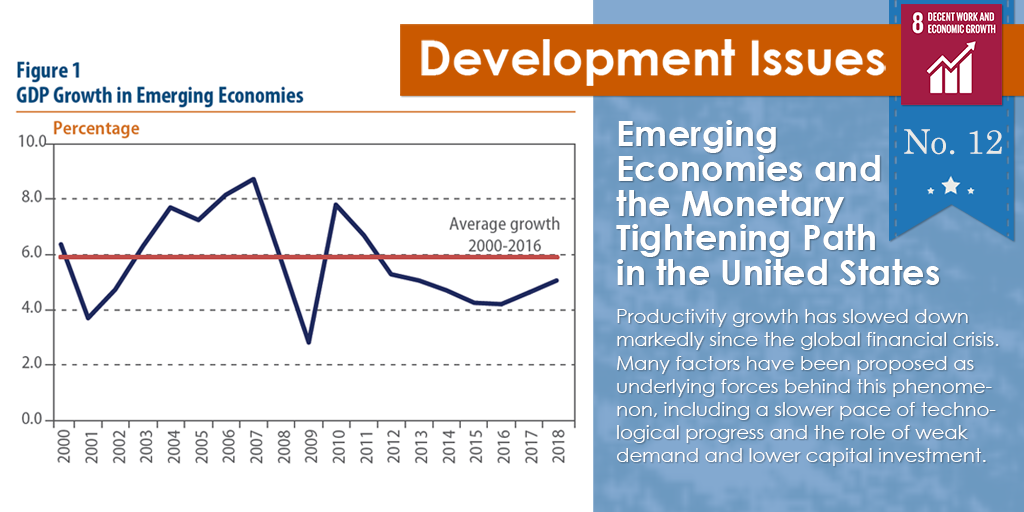

Lucas confirmed his long-held view that the welfare gains from stabilisation policy must be fairly modest. While this result rests on important simplifying assumptions, it seems to have proven to be a fairly robust finding. In recent times the overall stabilisation problem has become much less severe. In particular, economic volatility — measured by the standard deviation of quarterly output growth — seems to have fallen considerably in many industrialised countries when comparing the recent two decades to the preceding post World War II experience.

Some economists, including David and Christina Romer, suggested this to be due to a fundamental change in the understanding among policymakers about what aggregate demand policy can accomplish. This possibly validates the view that, in the past, severe recessions have been partly caused by over-ambitious macroeconomic policies. Clearly other views have been expressed, including the one that the recent experience is simply due to a fortunate sequence of extraordinarily small economic shocks.

Arguments for Reserve Requirements

In general, stabilisation policies can be implemented with the aid of either monetary or fiscal policy. As to the role of monetary stabilisation policy, let me take the example of the euro area. In the euro area the Maastricht Treaty assigns to monetary policy the responsibility for maintaining price stability.

The clear assignment of price stability as the overriding objective of the European Central Bank — specified by a quantitative definition — provides guidance to economic agents as to what can be expected from monetary policy. Without doubt this enhances the credibility of monetary policy, contributing to the anchoring of medium and long-term inflation expectations in the euro area.

Stable inflation expectations eliminate an important source of macroeconomic instability, namely the possibility that economic shocks affecting inflation in the short-term become amplified via a corresponding adjustment in inflation expectations. In turn, the stability of these expectations contributes to economic welfare via a reduction of inflation risk premia contained, for example in nominal bond yields. By insuring price stability, monetary policy can thus make an important contribution to macroeconomic stability.

In its monetary policy strategy the Eurosystem has adopted a medium-term orientation. The forward-looking nature of this strategy insures that timely action is taken to address any potential threats to price stability. Yet, the medium-term orientation also reflects the existence of economic shocks, the consequences of which monetary policy cannot control without inducing excessively high variability in real activity and interest rates.

A medium-term orientation should effectively guarantee that monetary policy itself does not become a source of economic fluctuations: As is well-known, monetary history is full of examples where monetary policy activism — concerned too much with the short run — led to a sequence of decisions which had to be reversed within short periods of time. Such a policy is a source of instability and generates results opposite to the ones initially envisaged. Overall, the medium-term orientation of monetary policy — guided by the objective of price stability — helps policy concentrating on the relevant economic shocks, that is on shocks and economic developments that monetary policy can effectively address.

Fiscal policy can promote macroeconomic stability by sustaining aggregate demand and private sector incomes during an economic downturn and by moderating economic activity during periods of strong growth. These work through the impact of economic fluctuations on the government budget and do not require any short-term decisions by policy makers. The size of tax collections and transfer payments, for example, are directly linked to the cyclical position of the economy and adjust in a way that helps stabilising aggregate demand and private sector incomes.

Orderly and Effective Insolvency Procedures. Global Financial Crises and Reforms. Government Austerity and Socioeconomic Sustainability. Managing Systemic Banking Crises. World Economic Outlook, September The Global Demographic Transition. Economic Reform and Growth. Measurement of Fiscal Impact: Methodological Issues - Occa Paper Sources, Disclosure, and Management.

International Money and Credit: Overcoming Developing Country Debt Crises. The Special Data Dissemination Standard: Guide for Subscribers and Users. The Experience of Transition Economies. A Collection of Empirical Studies. Instruments of Monetary Management: Issues and Country Experiences. Financial Sector Crisis and Restructuring: Fiscal Policy for the Crisis. Default in Today's Advanced Economies: Unnecessary, Undesirable, and Unlikely.

Limiting Central Bank Credit to the Government: Monetary Policy in Dollarized Economies. Frameworks for Monetary Stability: Policy Issues and Country Experiences. How to write a great review. The review must be at least 50 characters long. The title should be at least 4 characters long.