Savings and Interest Rates – What They Can Really Mean

The most that savers are likely to see is increases to 0. Possibly but the tone from the Bank of England governor suggests the next rate rise might not be until at the earliest. That said, household finances are under intense pressure, with the average person spending more than they earn, piling up debt or running down their savings. If the Bank of England raises the base rate by another 1.

Interest rates explained - Money Advice Service

That would knock a huge hole in the personal finances of many families — which is why the Bank of England is unlikely to go down that road if it can possibly avoid it. One of the striking new developments in the mortgage market is the sudden availability of year fixes at interest rates that are only marginally above the two- or five-year fixes taken out by most households. HSBC, for example, is allowing borrowers to lock in for 10 years at only 2. Given the rising interest rate environment, longer-term fixes are likely to be much more popular this year.

How will interest rate rise affect mortgages, savings and property?

Savers are increasing their real wealth. However, if we have negative interest rates, interest rates of 0. In , the saving ratio rose sharply — despite a cut in interest rates. Higher interest rates also make it more attractive to save money in the UK, as opposed to other countries. In India there is no social security. Those who do not get pension it is their only income and if Govt snatch that amount it is tantamount to push them to slow death.

Here economic argument does not hold good, take it as a social duty, duty to your old father. Your email address will not be published. Leave this field empty. An increase in interest rates will make saving more attractive and should encourage saving. A cut in interest rates will reduce the rewards of saving and will tend to discourage saving.

The fear of unemployment and recession was greater than the effect of lower interest rates Income and substitution effect of higher interest rates. If interest rates fall, the reward from saving falls. This is the substitution effect — with lower interest rates, consumers substitute saving for spending. However, if interest rates fall, savers see a decline in income because they receive lower income payments. A pensioner relying on interest payments from saving may feel he needs to save more to maintain their target income from savings.

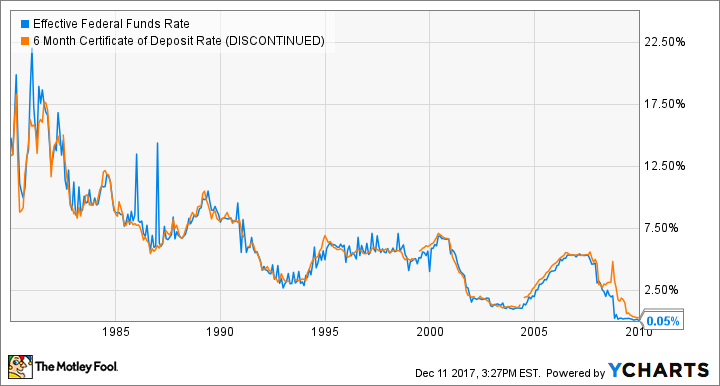

Base rates and bank rates Usually, a cut in Central Bank base rates leads to an equivalent fall in bank rates.

Before the crisis, 1-year fixed rate saving bonds were very close to the Bank of England base rate. However, since the Funding for Lending scheme was introduced in , saving rates have fallen for both 1-year fixed and interest rates on instant access saving. Where will I earn simple interest?

Where will I earn compound interest? Savings accounts and bank accounts both earn compound interest. Where will I pay compound interest? Credit cards , home loans and car loans generally work on compound interest.

While home and car loans are calculated to be paid off by the end of a pre-determined term, credit card interest can compound indefinitely. Too much maths for your taste?

NDTV Beeps - your daily newsletter

There are also a couple of different types of interest rates and they each have their pros and cons. This one is pretty self explanatory - a fixed interest rate is set at a certain percentage for the life of your loan or account. A variable interest rate does just what the name suggests too - it varies.

- How do interest rates affect savers and saving levels? | Economics Help.

- Jane Long: Texas Journey: Tejano Hero (Texas Heroes For Young Readers)?

- The Federal Reserve’s Role.

- How will interest rate rise affect mortgages, savings and property? | Business | The Guardian.

- How Banks Set Savings Account Rates?

- What Are Interest Rates? | Interest Rates | Mozo.